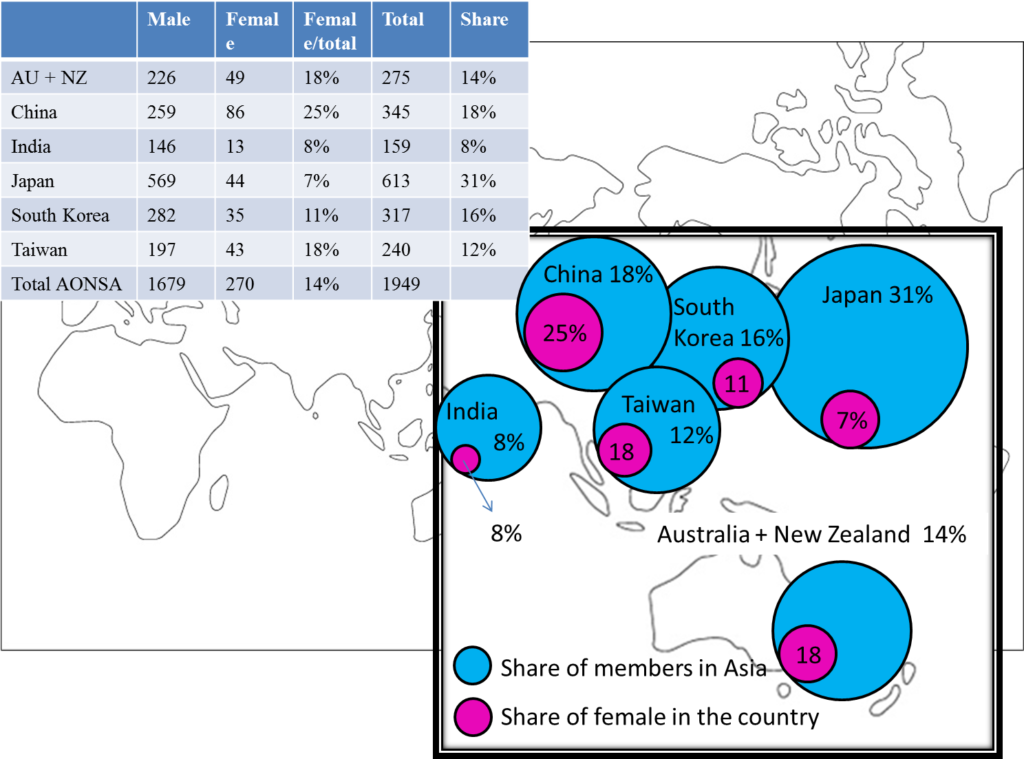

I was doing a research on neutron scattering societies in Asia. Neutron scattering is one techniques to study condensed matter physics. Neutron is one of most useful and suitable quantum beam for studying structures and interactions in material. To produce neutron, we need either reactor and accelerated (these days we have another compact neutron source but I don’t write about it here.). Today, I am not writing techniques but people. The figure is showing the number of member who belong to the neutron scattering society in Asia. Statistics I have taken from AONSA (Asia Oceania neutron scattering association). Globally, we have three organization, which are European ENSA and American NSSA, and AONSA. AONSA is the newest but the others are not also so old either. We have conference every 4 years, the first one was held at Tsukuba, Japan in 2011 and 2nd one was held at Sydney, Australia in 2015.

According to statistics, Japan has 31 percent share as the number of member in Asia. Japan started neutron scattering experiment earlier that other Asian countries so I also want to emphasize the quality of researcher you are watching here is very high. Japan has invested long time to cultivate the community and science. Now, Japanese research reactor JRR3M (20MW) is going to be back in 2018 April after the earthquake 2011 March, finally authority is going to approve to use it. So, we will have one research reactor JRR3M and one world top class accelerator J-PARC (1MW). We will have more than 50 neutron scattering instruments in total. (OPAL reactor (20MW) in Australia who I work for has 14 instruments) Now J-PARC impressed me even compared with SNS, Oak Ridge, TN, U.S.. The problem of J-PARC, they are not producing paper. (Oh, I have to write more) Of course Chinese community is growing faster and will do more experiment and science in Asia, which occupies 18 percent. But Chinese could not start research reactor close to Beijing yet which is ready from 2012 and their accelerator is now under construction, it still takes time to have their own research. I believe Japanese have to reach them to help them to pursuit their science while they develop their own community. Korean has built their community which occupies 16 percent. They have state of arts reactor (30 MW) while they have issue of structure of reactor so they had to step back for 2 years (as long as I remenber). I know a few distinguish professors who retired helping them. They have many researchers I hope reactor will run smoothly and they can grow. Taiwan has community of 12 percent. Taiwan has grown community while the biggest problem for them was budgeting. Taiwan decided to invest synchrotron X-ray scattering instead of neutron scattering, so they haven’t built any reactor or accelerator as their neutron source. So they have agreement with Australia to build their instrument in Australia OPAL reactor and neuron scattering cultivation program. That is the reason why I am sent here. Australia and New zealand has 14 percent. I will write next paragraph. Unfortunately I don’t have much information for India.

Australia has OPAL reactor (20 MW) and working very well. They run reactor 300 days which is very impressive. The other institutes in the world have limited beam time because of budgeting. Australian can run because they are making IR so they can make money because OPAL is only reactor this country has. Scientifically speaking, there is almost no excerpt in inelastic neutron scattering (which I am currently working on) in Universities here. I only know one who is not Australian. I know very good one in our institute but it is good to have professors in universities because professors can have students and students become graduate students and some of them becomes researchers and professors. The reason we don’t have local expert is because experiment instrument we have are basically only instrument we can study inelastic neutron. We have three inelastic neutron scattering instruments which are running less than 10 years as far as I know. Ours is open to user for almost 2 years. So it takes time to cultivate community. One reason I came to Australia for Taiwan, I spent 30 percent of my presentation time in interview for how do I expand this the instrument and community in Taiwan and Australia. Whilst, I can have a lot of time experimenting and experiences because community hasn’t grown yet. Roughly, they are 10 of instrument in the world. Japan has two of them but we are not using because JRR3M is not running. So only Australia is running these instrument in Asia. I thought Australia was good time to grow and expand for Asia and Oceania. I personally think Japanese have to provide more opportunity for Asian. I am very sure JRR3M will be ready soon. JRR3M (20MW) is bit old which was built 1990 while I realized in here Australia how difficult to make good instrument from scratch. So 30 instruments has run for 20 years already should be able to provide good science if research idea is good.

Some of you realized that ratio of female researcher in Japan is low. This is generally seen in Japan. The economist showed on daily chart on “The gender gap in science”, Japan is the worst among the subjected 27 area. “In the EU, and in eight of the countries considered, the share of women authors grew from about 30% in the late 1990s to about 40% two decades later. Brazil and Portugal are closest to equality, each just a percentage point shy of a 50-50 split. In Japan, by contrast, barely a fifth of researchers are female. ” the Economist says. In neutron scattering, Japanese is doing worse than that statistics. Compared with the other countries in Asia as well, I wonder why female researchers are so few in Japan. I hope female researcher will grow in Japan so we will have more researcher and diversity. The one concern is I knew one big professor moved from one of women universities to Riken. As you can see, even though it is not perfect, 25 percent of member in China is female. I hope a lot of Chinese female researcher inspire Japanese people to work in neutron scattering. Australian female researcher who are in advisory committee she reports on the meeting there was no female at advisory committee in Japan, our neutron scattering society is dominated by male. Advisory committee is the place the beam time allocates so I want them to have less inequality. I know still gender inequality is happening in the world but for Japan have to work harder than other countries. Since more women are working in Japanese society, I hope that happens in neutron scattering community too. Japanese have a lot of room to improve here to contribute neutron scattering science in Asia.