I am not economist so I don’t know but I want to make some sense on Australian Economy. Since I was born in Japan, had lived in the U.S. and am living in Australia. I can see the clear differences between Japan, the U.S., and Australia. So today, I would challenge myself to understand, at least make sense, on Australian economy. I wanted to write this when I understand Australia fully but it never happens anyway. And I wanted to make clear on what I felt when I just came this country, I honestly thought like “what is wrong with the economy of this country?” After living few years, my feeling was bit relieved, I might say paralyzed, but it is good time to reflect on it to have conclusion.

The biggest question here is why I have to pay so much for properties, foods, and daily essentials even though I am paid better than in Japan and the U.S.? Economic indicators look solid at a first glance for people outside of Australia however you quickly realize you don’t feel richness as indicators tell you if you live here. You will get higher salary but you have to pay a lot for almost everything. If the world were truly global, this economy would have to be adjusted. But it seems not. Anyways. Let’s see the facts backed by data. Again, I am not economist so please excuse me if I am using wrong parameters to see.

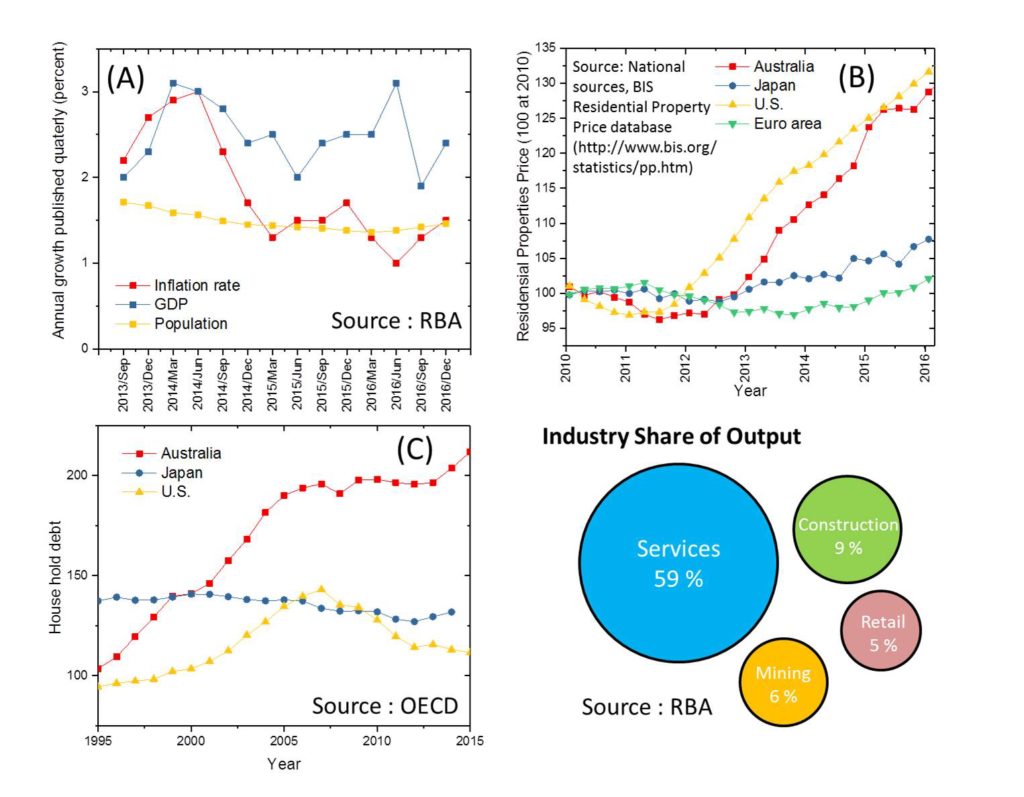

Let’s see 9 factors in Australian economy to get snapshot. The data was published Federal Reserve Bank Australia published March 8, 2017. GDP growth 2.4 % annually, inflation rate 1.5 %, cash rate (interest rate) 1.5% , Australia dollar A$=US$0.7671, Population 24.1 million, with 1.4 % annual growth, unemployment rate 5.8 % (which is suppose to be 5 % is full employment, so 0.8 % people are out of work). Average weekly Earning $1162, Household saving ratio 6.3 %, Residential dwellings $631000, these are 8 of them. I will talk about industry share of output key factors later.

Did you get snapshot? Yes? I realized that I had believed this country is growing but it is not. Australia is supposed to, and people still believe, have fundamentally strong economy since GDP of Australia grows faster than that of developed countries, such as Japan, the U.S, and Europeans. I was blindly thinking so too. But see, its GDP grows 2.4 % annually, while inflation rate is 1.5 %, and its population grow 1.4 %. (Figure (A)) They are not getting richer? No. Now I am feeling Japan is not bad after all. GDP grows slowly while its population is shrinking and they are in deflation for long time. And Japan has no natural resources as Australia does. So next question is when this slowing started? As long as I find in few years data, it has been for at least 3 years. It is convincing that the wage is not growing and A$ is getting cheaper last 5 years.

“Many people are struggling to make ends meet. We have the lowest wage growth in a generation.” Treasurer Scott Masison said in March, 2017. I see. Average weekly Earning $1162 but grew only 1.6 % in 2016, and saving ratio 6.3 % and drop rapidly since last July. So Australia is not growing as I thought. Growing slow is not problem. But, Australia now is the problem. The problem is Australia has gone 25 years makes people here paralyzed like they are doing O.K. even when they are not. There are two big problems, they are mining boom and housing bubble.

Australia is called “Lucky country”, people outside of this countries have called them so enviously. Australia continent is huge and weather is very nice. People can enjoy gorgeous beaches and mountains and there are not so many people here. Australia is fundamentally strong country. They have mining, so they can sell iron ore and coal. They have become rich while they took it for granted too much. Mining boom has ended as China is running slow. As the author of Boom to bust put it “Australia was then in the middle of the biggest mining boom in its history, stemming from increased demand in China. In the decade to 2012, the value of its mined exports tripled; mining investment rose from 2% of GDP to 8%. From January 2003 to February 2011 the price of iron ore, which these days comprises 17% of Australia’s exports by value, rose from $13.8 to $187.2 a tonne. Australian thermal coal, which accounts for 12% of its exports, rose from $26.7 to $141.9” Mining industry became too big compared to the size of Australian economy and it is going to fail.

Who buys iron and coal? China, South Korea, and Japan. The biggest problem now is China. China is growing slowly now but the Chinese government says China would grow 6.5 percent every year? Since GDP = C + I + G + (Ex-Im), the authority can directly control is only government spending. My friend told me Shanghai’s road are remade every few years. They are throwing money just to make up the GDP growth. The communism still would keep country running but the world have to adjusted sometime in the future. But the problem here is Australia depends too much on China.

So the next is housing bubble. I don’t know how many people have been taking seriously. As experience of Japan and the U.S.. I know this very well. Let’s look at stock market here, I can give you link. (http://www.marketindex.com.au/all-ordinaries) And you can plot companies market capitalization and growth last year. You can get it? If you don’t get it, I can give you a hint. Look at top 4 (if this is too easy for you, then 5th). If you don’t get it, you should learn history. Commonwealth Bank (CBA), National Australia Bank (NAB), ANZ, and Westpac (WBC) are known as the Big 4 banks in Australia, controlling more than 80% of the domestic banking business. Globally, no one has heard these banks. They should be too big to fail because they are controlling 80 %. Have you read the too big to fail. Just one Lehman Brothers could shake entire American economy. Big 4 is too too big.

Then next is residential properties. Australia’s foreign investment policy for residential real estate is very clear, it is basically saying non resident foreigner has to buy newly build new properties, which leads to further bubble, who is going to live new properties after the Chinese leave? People buy home not to live but to invest. How come REIT market here is ranked 3rd largest REIT market in the world, which is 9.86 trillion yen? (2nd Japan 11.17 trillion yen and 1st U.S 85.52 trillion yen). Japan’s GDP is three times larger than here and its population is at least 5 times larger than that of Australia. Can you believe it? So finally, as shown in Figure (B), residential properties is growing, earnings stay almost same, so naturally the average of household debt is growing (Figure (C)).

Here I add finally 9th factor, industry share odf output key factors they are Service 59 %, retail trade 5% , construction 9%, manufacture 7% , mining 6% , and the rest 14 % as shown in Figure (I didn’t get the number for agriculture this country should do very good.). Did you get it? There are too much of banking (I didn’t get the number either), retail, construction, and mining industry, is this developed country? I don’t think so. What would happen when both mining and housing have problem? How this country comes back after the bubble collapse?

This really depends on how China lands finally. I know China can avoid collapsing for a while but history told us they can’t do it forever. I am a Japanese, I know it. As no one in America and European had not believed Japanese had said before they have experienced bubble collapse. I know China and Australia don’t believe us. Now China and then Australian, people says “this time is or we are different” I know it is not. And I know everyone used to say so.